Learn From Industry Practitioners

Learn From Industry Practitioners

Covers TCFD, CDP, GRI, UNPRI etc

Covers TCFD, CDP, GRI, UNPRI etc

The financial performance of a business is no longer the only yardstick for its success and sustenance. Environmental, Social, and Governance (ESG) factors have gained frontstage as they contribute to long-term value creation, risk management, reputation enhancement, stakeholder engagement, and regulatory compliance.

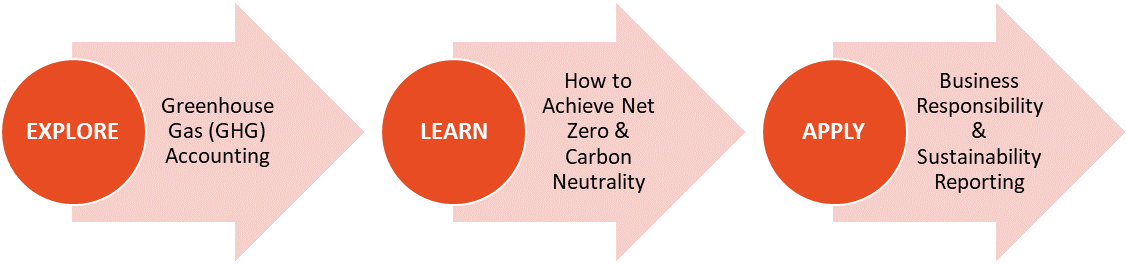

The ESG Bootcamp is designed to equip participants with a comprehensive understanding of how ESG factors impact business operations, GHG accounting, Frameworks and Reporting Standards, investment decisions, corporate responsibility, and sustainable practices.

Empower yourself with the knowledge and skills tonavigate the dynamic landscape of ESG considerations.

NIIFL launches $600 Million Bi-lateral India-Japan Fund for low carbon emission projects

To Read Full Story and Source of Information

A.P Moller – Maersk to Strengthen its Distribution Network in India with Over 500 Electric Vehicles

To Read Full Story and Source of Information

JP Morgan Says Trailblazing Rules to Boost India’s ESG Market.

To Read Full Story and Source of Information

U.S. and India Advance Partnership on Clean Energy.

To Read Full Story and Source of Information

Hyundai Motor To Invest $2.45 Billion in India EV Production.

To Read Full Story and Source of Information

In recent years, there has been a growing focus on ESG factors in India & companies are increasingly adopting sustainable practices to reduce their carbon footprint and minimize environmental impact.

The need for ESG roles may continue to increase as more industries integrate these functions into their operations and place an emphasis on sustainability and community relations.

To Read Full Story and Source of Information

To Read Full Story and Source of Information

• Learn from industry professionals with real-world experience.

• Gain insights into the emerging trends, standards, and practices.

• Engage in discussions and explore networking opportunities.

• Diverse cohort to create enriched learning experience.

• Hands-on Projects, Cases and Assessments.

• Examples on how organizations integrate ESG into strategies.

• Easy to translate learning to your specific industry or role.

• Develop understanding ESG principles across industries & roles.

This component evaluates and mitigates environmental risks in business by reducing carbon emissions, conserving resources, promoting renewable energy adoption, and implementing waste management practices.

It involves a company's commitment to positively impact society through workplace diversity, fair labor standards in the supply chain, engaging in community initiatives, & upholding human rights.

This ensures ethical decision making, safeguard shareholder interests, transparent reporting, independent board oversight, effective risk management, & strong internal controls to prevent frauds.

Raise awareness about the importance of ESG factors in business and investment decisions.

Promote sustainable practices and responsible behaviors among businesses.

Encourage transparency and accountability in reporting ESG metrics.

Foster collaboration between businesses, investors, & stakeholders to address sustainability challenges.

Enhance social impact by promoting fair labour practices, diversity, inclusivity, and community engagement.

Support good governance practices by advocating for ethical leadership, board independence, and shareholder rights.

The program collectively contributes to empowering participants with the necessary tools, insights, and capabilities to drive positive change, foster sustainable business practices, and contribute to the wider goal of creating a more sustainable and responsible business ecosystem. These outcomes may include:

Understanding the key concepts of ESG and their relevance in various industries.

Learn Applications of ESG Metrics and Reporting to support decision making.

Assess impact of business operations on environment & apply strategies to deduce carbon footprint.

Evaluate factors such as diversity, employee well-being, & community engagement in decision-making.

Assessing governance structures to ensure transparency, accountability, and ethical behaviour.

Applying quantitative tools and frameworks to measure ESG performance.

This ESG Bootcamp is designed for professionals across industries who aspire to integrate ESG principles into their decision-making. Whether you are in finance, management, or CSR this bootcamp equips you to navigate the evolving landscape of responsible business practices.

Investment Professionals & Financial Analysts :

for enhanced decision making by considering long-term sustainability & risk mitigation.

Investor Relations teams and Senior Managers :

who want to effectively communicate the company’s ESG Initiative to investors.

Executives and Board Members :

responsible for setting strategic direction & managing risk.

Compliance Officers :

ensuring adherence to ESG regulations.

Sustainability Officers and Consultants :

guiding organizations on ESG practices.

Risk Managers :

identifying potential ESG-related risks.

Investors and Asset Managers :

Interested in integrating ESG factors into their investment decisions.

Students :

aspiring to learn ESG can open new career avenues in ESG function.

The training program will employ a mix of presentations, interactive workshops, case studies, group discussions, and Q&A sessions/Assessments. Peer to Peer Industry comparisons, Practical exercises and real-life examples will be used to reinforce learning and encourage active participation.

Live sessions will be conducted by experienced industry consultants and practitioners from Grant Thornton & NSE Academy. Instructors will provide valuable insights as they have a deep understanding of ESG industry practices across markets.

| DURATION | DAY | FORMAT | LXP |

|---|---|---|---|

| 20 Hours / 4 Days | Weekend Sessions | Live and Direct- To-Device | NSE Knowledge Hub |

| Details | Fee | Fee with 18% GST |

|---|---|---|

| Registration Fee | INR 10,000 + 18% GST | Apply Now INR 11,800 |

| Program Fee | INR 20,000 + 18% GST | INR 23,600 |

| Total Program Fee | INR 30,000 + 18% GST | INR 35,400 |

Learning is more impactful when you join with your colleagues.

Grant Thornton Bharat (GT) is truly a global organization with 62,000+ people in more than 130 countries. No matter, how big the organization or the international challenges you face, GT has the resources to match and provide solutions. The organization has member firms in over 130 countries worldwide. It is ranked one of the top six firms in 88 markets around the world and established in all major business centers and emerging markets. The organization serves India region with 13 offices in all major cities with more than 15,000 people.

NSE Academy Ltd. is a wholly-owned subsidiary of the National Stock Exchange of India Ltd. (NSEIL). NSE Academy enables the next generation of BFSI and FinTech professionals with industry-aligned skills through capacity-building programs and certification courses, powered by an online examination and certification system. The courses are well researched and carefully crafted with inputs from industry professionals. NSE Academy works closely with reputed universities and institutions across India in building a competent workforce for the future of BFSI and FinTech. NSE Academy also promotes financial literacy as an essential life skill among youngsters - a contribution towards financial inclusion and wellbeing.

It is clarified that NSE Academy does not, in any manner whatsoever, assure, warrant, guarantee, or promise any job/placement/advancement to any Participant. Under no circumstances, NSE Academy shall be held responsible/liable for failure on the part of the Participants to pass / successfully clear the interview process or the requirements to successfully secure a job.

The information in this document can be used only by NSE Academy Ltd. It may not be reproduced in whole, or in part, nor may any of the information contained therein be disclosed without the prior consent of the authorized representatives of "NSE Academy Ltd." except within the organization.

Any form of reproduction, dissemination, copying, disclosure, modification, distribution, and or publication of this material is strictly prohibited.

The "Bootcamp on Environmental Social & Governance (ESG)" program is administered by the NSE Academy Ltd and Grant Thornton Bharat LLP. The participants need to complete certificate criteria independently to be eligible for the respective certificates.

The Course Content/Outline mentioned herein is indicative and may be modified by NSE Academy in the best interest of the participants.

The fee paid is non-transferable and non-refundable.